The cultural and creative sector in Sweden

![]() Posted by Volante / / Research

Posted by Volante / / Research

Volante Research has produced new Swedish cultural and creative sector economic estimates. The report traces the development between 2007 and 2010, and studies, among other things, entrepreneurship, employment figures, turnover, and added value.

An interesting aspect of the report is that we also compare different definitions of the creative industries. The reason for this is that all too often the sector’s development is referenced without specifying exactly what is measured.

To follow the complete discussion, download the discussion (in Swedish) here.

Comparing different definitions

In this report, the results for the size and change of the creative industries are presented according to two different definitions, which have been recognized in recent years. Also, comparisons have been made with other, internationally recognized, definitions. All of the definitions have been adapted to fit the European Classification of Industry Statistics, NACE Rev. 2.

The first definition is produced by the European Cluster Observatory (ECO), which gathers information about European clusters, cluster organizations, and cluster reports. Through financing from the Directorate-General for Enterprise and Industry of the European Commission, the observatory is run by the Stockholm School of Economics. In 2010, the observatory published a study, “Priority Sector Report: Creative and Cultural Industries”, comparing the size and concentration of the creative industries in different European regions. The report was later updated in October of 2012.

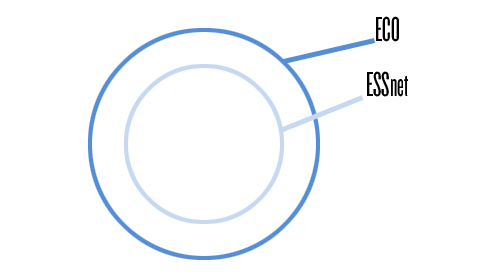

Figure 1. ECO in relation to ESSnet.

Simply put, the ECO definition includes more of the creative industries than the ESSnet definition, which only really covers the core cultural industries. However, this is not the description used in the ESSnet report: it is rather our own interpretation. Figure 1 illustrates how the two definitions relate to each other.

In these definitions, the starting point is, primarily, staying true to the core of the included sectors when discussing the cultural and creative sectors. The difference between the ECO definition and the ESSnet definition is that the latter does not always include supportive functions such as printing or the manufacture of musical instruments, nor does it include software producers. These two definitions are relatively narrow, and by staying true to the idea of the cultural and creative industries, we have decided that our two main definitions should cover too little, rather than too much. A large part of retail is excluded, since it is not statistically possible to separate the cultural and creative industry market from the rest.

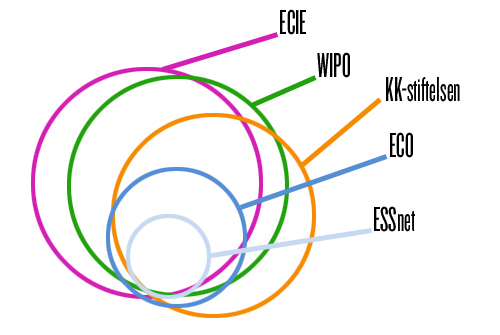

Figure 2 shows the relationship between three additional definitions. The first definition derives from the report “The experience industry 2003—statistics and comparisons”, published by the Swedish organization the Knowledge Foundation in 2003. The primary focus of the report was Sweden, and it gained wide recognition in the mid 2000s. The difference between the definition used in this report, as well as the definitions discussed here, and the definition presented by the Knowledge Foundation is that the tourism industry and the food sector are excluded in the latter. Together, the two sectors made up 38 percent of the experience industry as a whole. Another difference is that the fashion sector is included in the Knowledge Foundation’s definition, and not in the two definitions used in this report.

Figure 2. The relationship between different definitions.

(KK-stiftelsen = the Knowledge Foundation)

The second definitions was presented in the report “Guide on surveying the economic contribution by the copyright-based industries”, published in 2003 by the UN agency World Intellectual Property Organization (WIPO), which is dedicated to the use of intellectual property. This definition includes sectors where copyright is central. Unlike ECO and ESSnet, an important sector that is included by WIPO is the telecommunications sector. However, WIPO does not include museums and cultural heritage institutions.

The third definition was used in the influential report “The economy of culture in Europe” (ECIE), published in 2006 by the consultancy KEA on behalf of the EU Commission’s Directorates-General for Education and Culture. In line with the definition by the Knowledge Foundation, ECIE include the fashion sector.

During the years when these reports have been published (2003-2010), the Swedish industrial classification codes, the SNI-codes, have been updated twice. We have, because of this, been forced to update these definitions to SNI 2007. Thus, there might be some irregularities with the definitions originally published in the reports.

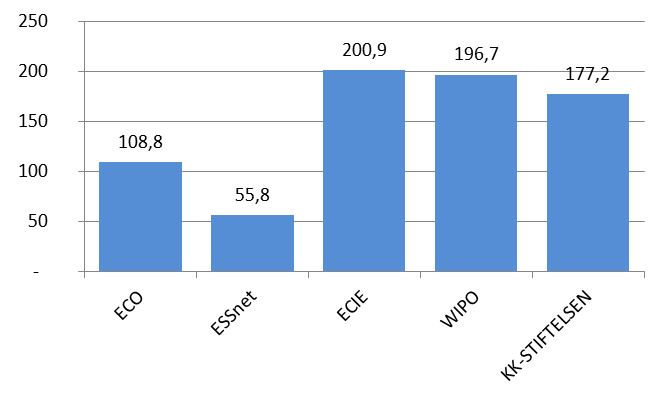

Figure 3 compares the results for added value in Sweden, 2010, according to the different definitions.

Figure 3. The size of the creative industries after added value, in Sweden 2010, SEK billion.

(KK-stiftelsen = the Knowledge Foundation)

The cultural and creative sector in Sweden

Below, some of the most important results for the creative industries in Sweden are presented. These numbers follow the definition used by the European Cluster Observatory.

Entrepreneurship and employees

In Sweden, 177,000 businesses are part of the cultural and creative sector — a figure that increased by approximately 5.4 percent a year in the period between 2008 and 2010. Close to 83 percent of all businesses are sole proprietorships and 98 percent have less than ten employees. More than 146,000 are employed within the creative industries, but only 0.1 percent of the businesses have more than 200 or more employees.

Turnover and GDP contributions

The turnover for the cultural and creative sector in Sweden, 2010, was approximately SEK 285 billion. The sector contributed to Sweden’s GDP with 3.3 percent.

Growth

In 2010, the growth for the creative industries was 5.5 percent. However, between 2008 and 2010 growth has shifted enormously.

Svenska

Svenska